As we know, it’s the people who innovate and create that help things develop in the business world. As usual, Prolific London has been researching one of the U.K.s most formidable interest rate traders and equality campaigners, Gary Stevenson. He has now retired from trading, but Stevensons’ journey is certainly one worth looking into.

Stevenson had a challenging start to life and didn’t come from a wealthy family. He was even expelled from school at the age of sixteen for drug-related reasons. So how did a working-class lad from Ilford make his millions?

What He Does And Why

Gary Stevenson rose to stardom in banking and trading in 2011 when he became Citi Bank’s most profitable trader. He achieved this by predicting that there would be an increase in economic equality, and his prediction bore fruit (we will explain how later).

Stevenson has gone on record and stated that he entered the interest rate trading space in 2008 at 21, propelled by a victory in a card game centred on trading. His journey commenced with an internship at Citibank, and he later secured a full-time position. Seizing the opportunities presented by the 2007–2008 financial crisis, he received his inaugural bonus in early 2009, amounting to £13,000. Subsequently, in his initial year, Stevenson earned just under £400,000, reaching his first million pounds by 2010 (an impressive feat in only two years in the game). He also engaged in strategic bets on the Greek government debt crisis 2011. This also proved fruitful for Stevenson, and he managed to take the right actions regarding the Greek economy.

Citi Bank Success

As of the close of 2011, as we mentioned previously, Stevenson had attained the status of Citibank’s most profitable trader. His success stemmed from trading activities grounded in the foresight that interest rates would remain stagnant due to the influence of wealth inequality on demand. Stevenson believed that the people with the most capital tended to save rather than spend, channelling their resources into property investments, thus shaping his trading decisions. His prediction was accurate, and that is how he made his claim to fame.

Retirement And Other Projects

In 2014, at 27, Stevenson decided to retire from trading and pursue studies in economics at the University of Oxford. However, he found himself depressed and disillusioned (in his own words) with the education he received, expressing frustration that meaningful change wasn’t likely to originate from traditional academic settings. Instead, Stevenson immersed himself in the works of economists such as Thomas Piketty, Emmanuel Saez, Gabriel Zucman, Atif Mian, Amir Sufi, and Ludwig Straub.

With the onset of the COVID-19 pandemic, Stevenson predicted a surge in house prices and shopping costs, anticipating an increase in inequality. He actively joined advocacy groups like the Patriotic Millionaires and Millionaires for Humanity, campaigning for a wealth tax. To broaden public understanding of economics, he established the YouTube channel GarysEconomics.

Political Interests And Media Projects

In 2021, Stevenson, along with 29 other U.K. millionaires, signed an open letter to Rishi Sunak urging the introduction of a wealth tax, criticizing the chancellor for raising national insurance instead of taxing the wealthy. He also proposed limitations on the duration for which individuals could retain their wealth.

Stevenson’s involvement in various media projects includes appearances in the Channel 4 documentary Cryptocurrency: Has the Bubble Burst? in 2022, featuring in Steffan Roe Griffiths’ short film “Gary Stevenson – Life Out of Balance” in 2023, and participation in BBC Politics Live.

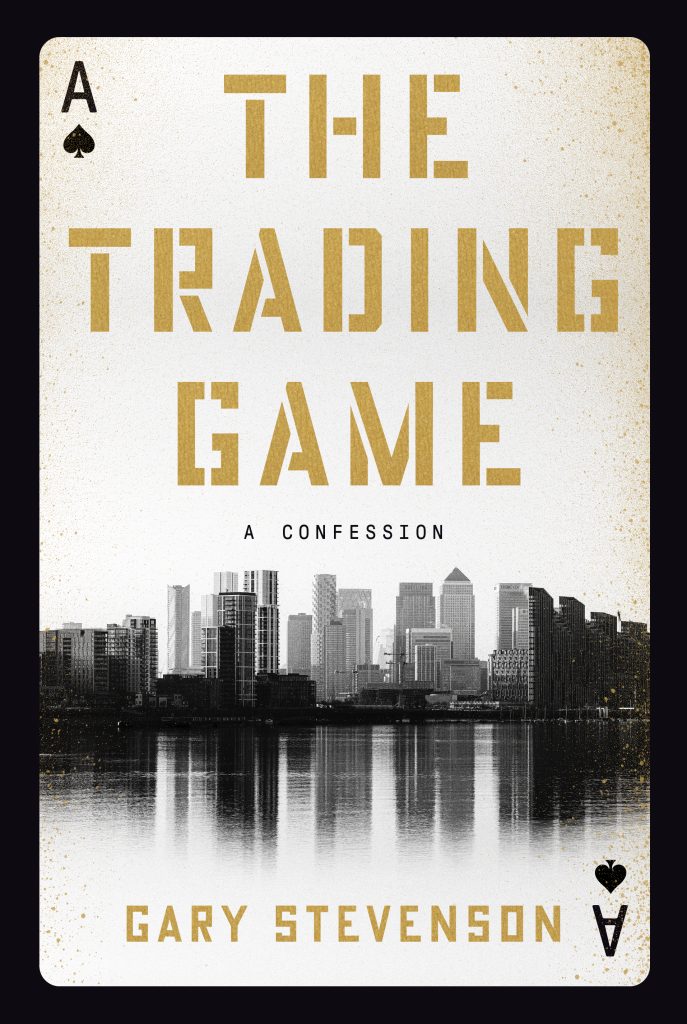

Book Deal

He penned a memoir titled The Trading Game, named after the Citibank event that facilitated his internship, which Penguin Books acquired in a six-figure deal. The book has just been released this month and has received critical acclaim.

In his debut memoir, Stevenson shares his journey from a challenging upbringing in Ilford, East London, where he creatively coped with limited resources, including makeshift shower solutions. The book also goes into more detail about his expulsion from school for selling drugs. Still, it explains that his aptitude in mathematics eventually led him to the London School of Economics. It touches on a few themes, such as his humble appearance, which led to Stevenson being judged by his peers because of his working-class background, and his discomfort during his time at the institution.

Stevenson has done all right for himself, though, and it wouldn’t come as a surprise if there is more success to come.