Since we human beings have moved further forward into this digital age, what we require from life has also shifted as time has passed. One thing we will continuously need though is the means to provide for ourselves, but in contrast, the way we do this (earn our money) has evolved over the years. As we are now constantly online it has become possible to work from anywhere you want, and more and more people are taking advantage of this. The need for a side hustle has also increased for a lot of people as the cost of living has skyrocketed since the pandemic and more and more people need a little extra income to provide for themselves and their families.

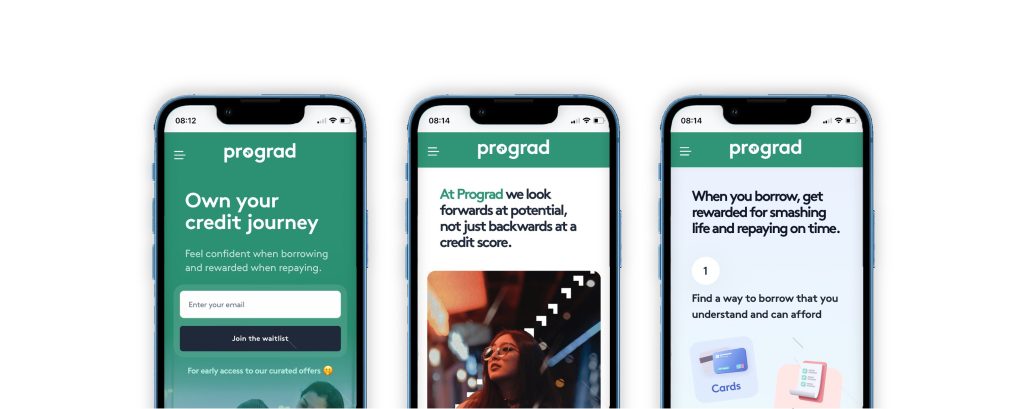

Today Prolific London will be focusing on a business that allows people to earn money from anywhere by providing people with the tools to take on a side hustle from the comfort of their own homes. The company in question? Prograd. What is unique about Prograd though, is not only do they provide the tools for a side hustle, but they also connect their users with banks and potential investment opportunities. Prograd is a one-stop shop for raising extra capital and then allowing its user the chance to grow their money by using various financial services.

About Prograd

Prograd, as we explained is a FinTech company and was established in 2021, in London. The firm was co-founded by Chief Product Officer Marco Logiudice and Chief Executive Officer Ethan Fraenkel. Prograd Limited offers a credit marketplace that helps customers make informed financial decisions. Utilising AI-powered credit-scoring technology, the company connects clients with numerous financial institutions, including Santander, Revolut, Starling, Fiverr, and IndeedFlex. This platform not only provides access to these service providers but also offers financial solutions for setting and achieving financial goals.

In January 2023, the company secured USD 2.5 million in seed funding from investors such as AGAM International Limited, Deloitte Ventures, Techstart Ventures, and Zaka VC. This money is now being used to help develop and improve their app and help the company branch out further and reach more users.

How it works

Prograds core ethos is that they believe everyone deserves to have someone working behind the scenes to help prevent them from making poor financial decisions. They state that schools should provide this guidance, but they often do not which can leave a lot of people vulnerable. Banks are also unlikely to help because, ultimately, the more informed customers are, the less banks profit (a tale as old as time).

Improve People’s Finances And Boost Savings.

So how do they do what they do? By evaluating individuals’ skills and circumstances, Prograd helps users select the best paths to achieve their goals. Their platform offers over 100 products designed to enhance quality of life, including:

- Side hustles and job opportunities

- Discounts

- Savings accounts

- Reward credit cards

Prograd tracks users’ progress and checks in with them to as they state on the company website “supercharge people’s financial journeys”. They provide insights into how users compare with their peers and offer the best resources for learning how to make smarter financial choices independently. Whether it’s going on holiday, buying a new car, or building more wealth, Prograd helps users hit their life goals faster.

No confusing financial jargon.

A lot of people are not familiar with financial jargon, and this is designed by the institutions on purpose as it gatekeeps a lot of information and helps the banks generate more money. Prograd simplifies things by offering interactive short videos and a wealth of content to explain every financial term on its platform. They aim to make finance as simple as possible for everyone, and it’s a service that aims to make life a lot easier for many people. Prograd is one to watch for sure.