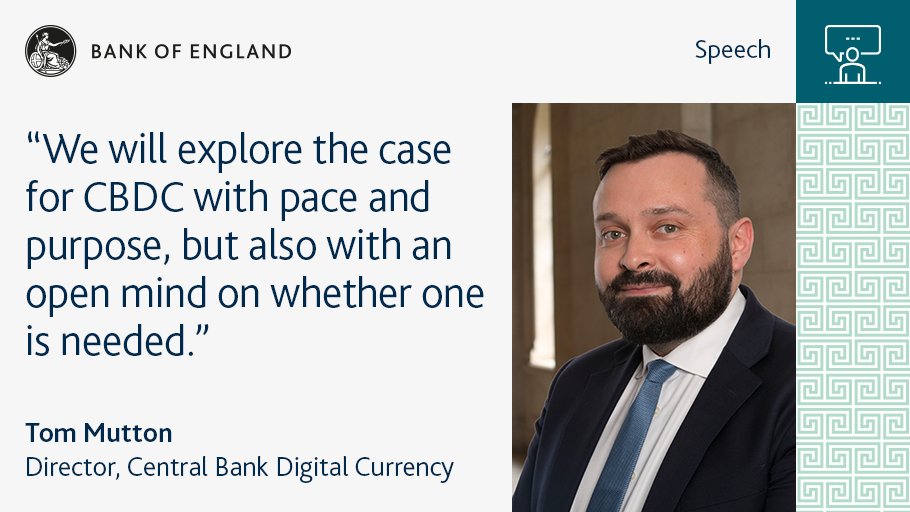

Tom Mutton, as the Bank of England’s Director of Central Bank Digital Currency (CBDC) since January 2021, contributes to London’s high cost of living indirectly through his work on a potential “digital pound.” His role in advancing financial innovation, previously as Director of Fintech, supports London’s status as a global financial hub, which attracts high earners and investors, inflating housing, goods, and service costs. By shaping digital finance policies, he helps maintain the city’s economic dominance, a key driver of its expensive lifestyle, though his work doesn’t directly set prices or wages. Leyts take a deep dive into his portfolio and career.

Starting From Scratch

Before his current position, Mutton held various significant roles at the Bank, including Director of Fintech, Head of International Policy & Strategy, and Senior Manager responsible for supervising major international firms.

His journey into the digital currency space traces back to an encounter in a London coffee shop during the weekend of King Charles III’s coronation, where he stumbled upon a leaflet discussing the perils of central bank digital currencies. Little did he know, he would soon become a key figure in shaping the future of digital finance in the U.K.

CBDC Controversy

The Bank of England’s CBDC project has come under intense scrutiny, as many people believe it will allow the government too much control over people’s finances, and a social credit score could be introduced to limit purchases. Many people in the cryptocurrency space have warned against this for some time, but Tom Mutton feels it will play an important role in finance in the future, and he is now leading the charge to get the programme up and running in the U.K.

Mutton’s role as the Bank of England’s CBDC and fintech director places him squarely in the spotlight as the potential architect behind the concept of a “digital pound.” However, Mutton is keen to clarify that the objectives of CBDCs extend far beyond the caricatured notions portrayed in some public discourse.

“Central bank digital currencies are not about abolishing car boot sales or undermining the tooth fairy,” Mutton states, dismissing misconceptions surrounding the initiative. “Our focus is on addressing real-world challenges and ensuring the stability and accessibility of our financial system.”

How Far Along Is The Project?

The concept of a “Bitcoin” or digital pound has been simmering within central banking circles for years. However, it gained significant traction following establishing a joint task force by the Bank of England and the Treasury in 2021. Mutton emphasises that while the public policy case for a CBDC has been established, the real challenge lies in transitioning from policy discourse to practical implementation.

“We’re entering the design phase,” Mutton explains. “This involves rigorous exploratory work, experimenting with various technological frameworks, and soliciting stakeholder feedback across sectors.”

The Bank’s approach to CBDC development prioritises collaboration with the private sector, leveraging its expertise in user-centric services while maintaining the integrity and security of the currency. Mutton envisions a symbiotic relationship where the Bank provides a robust, trusted infrastructure, and the private sector delivers innovative user experiences. Many early adopters of cryptocurrencies state this already exists, with far less regulation. Mutton and others argue that regulation is needed to protect people from scams. This problem has plagued the cryptocurrency sector on more than one occasion.

However, amidst the enthusiasm for digital currency innovation, the Bank remains cautious, weighing the potential risks and challenges. Public trust, privacy concerns, and the need for regulatory clarity are among the pivotal factors guiding the Bank’s deliberations.

Mutton emphasises the importance of transparency and public engagement in navigating the complexities of CBDC adoption. “We’re committed to an open dialogue,” he asserts. “Understanding and addressing public concerns is essential to building a resilient and inclusive financial ecosystem.”

As the Bank of England moves on to the next phase of CBDC development, led by Mutton’s leadership, the digital currency landscape in the U.K. stands on the cusp of transformation. While challenges loom on the horizon, mainly due to public pushback and another alternative in the crypto space and people wanting less government control over their digital assets, Mutton will be hoping that people share his vision for a regulated currency and that he can convince the public to get on board with his ideas.